In 2024 we launched our inaugural Sports Leadership Benchmark – creating a group of C-suite leaders running sports rights-holders in the UK, and asking them, confidentially, to provide a quantitative analysis of their organisation’s finances and commercial challenges and opportunities.

Our aim was to explore sport’s relationship with data and technology: two much-discussed topics within the industry, but areas in which we at PTI believe most rights-holders are commercially behind the curve.

Why is this important? It is our contention that for the vast majority of rights-holders, the world over the last 15 years has changed at such a rapid pace that data and technology provide the only reasonable keys to unlocking long-term salvation.

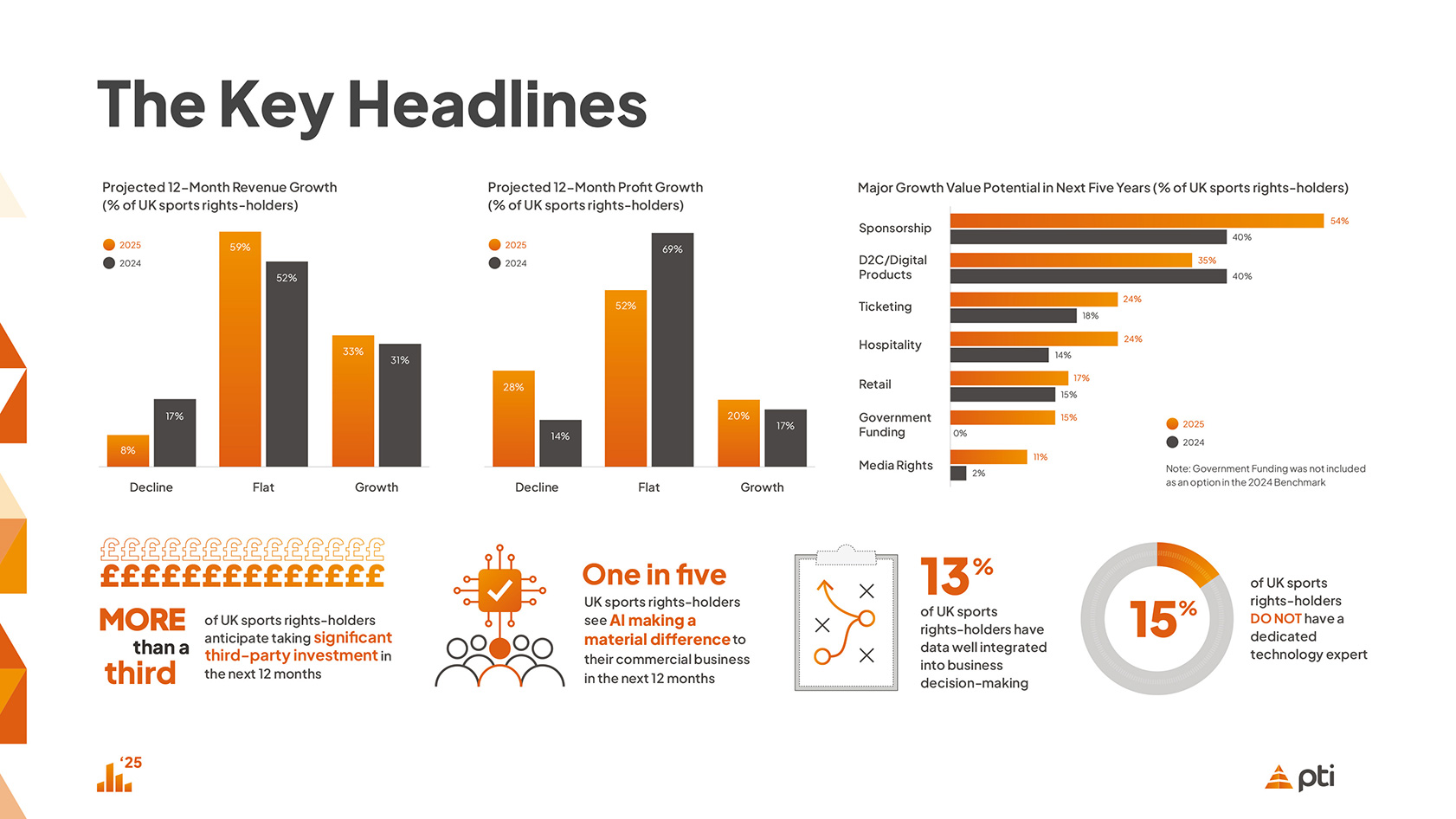

This year’s Benchmark bears that argument out, and shows that there is:

- An increasing schism between the haves and have nots

- A disconnect between commercial ambition and action

- A disappointingly low industry-wide level of data sophistication

- An absence of technology expertise at the top table

- Often unappealing investor propositions being offered by sport.

Whilst the very top of the industry continues to grow, that growth is skewing the picture for everyone else. Our analysis shows that in the UK, only 12.5% of sports rights-holders sit in in the “top tier” with annual revenue of £100m or more.

On the whole it is these organisations who are still able to point to growth (even if not always at unit price level) in their media rights; to whom sponsors are still attracted; and who have strong, predictable footfall on event days.

However, these organisations are the exception not the rule, and almost 9 in 10 fall below that threshold, often running variations of the same tired business model with inefficiencies in their operating structure and a daily grind to raise revenue.

With rising cost bases, and ever more competition for their customers’ time and money, there is little relief from the daily pressure to keep heads above water. The rich are getting richer, the rest are fighting for an ever decreasing share: the Squeezed Middle.

The Data Disconnect

Whilst it is cheering on the surface to see an uptick in our respondents’ overall optimism for their financial prospects, there appears to us to be a serious disconnect between those top-line ambitions and what many have put in place to make them a reality.

Our 2025 Benchmark demonstrates that – despite having talked about data, and no doubt spent considerable sums in the past 15 years – the vast majority of UK rights-holders appear still to be stuck in square one as regards their data sophistication and consequently the commercial returns they are able to demonstrate are sub-optimal.

Whereas most are pragmatic about the potential for some of their traditional revenue streams such as ticketing and retail, the two areas seen as having the highest ceilings for growth are Sponsorship and D2C for the second year running. Whilst D2C by its very definition is reliant on strong customer data, it is also our contention that the battleground for sponsorship spend is increasingly predicated on who has the best data.

Rather than placing it at the heart of their business, thinking around data and digital technology remains very much as a “bolt on” for many organisations. The world is spinning around us ever quicker, but too many remain wedded to an operating model that is being eroded by changing consumption habits, ongoing economic challenges and better (many, digital) alternatives for our customers’ time and money.

We recognise that digitally-powered change programmes take time and require upfront investment (we tend not to use the phrase “digital transformation” these days as the technology should be only the final piece of the puzzle). It was for this reason we wanted to investigate how many rights-holders are expecting to receive third-party investment and how any such capital might be deployed. Perhaps unsurprisingly almost a fifth said any such cash injection would be spent on athletes while less than 10% saw technology or innovation as a priority.

The apparent disconnect between all these narratives can be partly explained by the lack of senior technology representation within many sports organisations. Our report shows that more than half do not have a technology representative at Director level or above (only 17% have a CTO) and 15% do not have anyone responsible for it at all.

Whilst there is an endless supply of reports trumpeting infinite and universal growth for sport, we believe that our 2025 Benchmark brings a dose of reality. Its align closely with our daily experience, working with clients who can see the way the wind is blowing and want to address the fundamentals of their business.

This has to be the way forward for the nearly 90% of rights-holders for whom the post-COVID age represents a struggle to make ends meet. It is not an overnight process; it requires patience and some investment, but a more strategic approach to data and technology represents the best solution for the vast majority.

You can download the full report for free here